Don’t go it alone! Audit Representation and Tax Resolution services you can count on!

Few things in life are more unsettling and nerve racking than the dreaded letter from the IRS that states you’ve just won the audit lottery, with the possible exception being the next letter from the IRS that says you owe them thousands of dollars you just don’t have. While nobody can prevent you from getting that first letter, securing the expertise of taxproinc President and second generation enrolled agent Robert A Bolduc II, EA, ATA, ATP at the onset of the audit may prevent the second letter from arriving. (Learn more about who enrolled agents are and their specialized tax knowledge.)

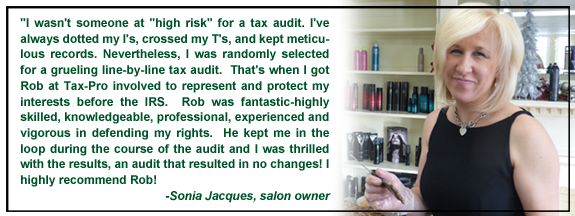

Well respected and known for being a fierce advocate for the clients he represents before the IRS in taxing matters such as audits and collection cases, Mr. Bolduc works hard to ensure the most favorable outcome for all his clients. He’ll protect your rights as a taxpayer ensuring the IRS is treating you responsibly while pleading and presenting your case before the IRS examiner or Revenue Agent. Most importantly, Mr. Bolduc believes in being upfront and honest with the client regarding the clients chances on positively resolving the matters he is being asked to represent before the IRS.

As an EA, Mr. Bolduc can represent clients in all 50 states at all levels of the IRS up to and including the Appeals division. Additionally, Mr. Bolduc oftentimes represents clients in other states regarding state tax matters. If you have ANY of the following IRS or State tax issues, contact Mr. Bolduc today to set up a free consultation and secure a strong advocate to protect YOUR rights!

Mr. Bolduc can assist you with:

-

IRS and State Audit Representation

- IRS Collection Cases

- Levies & Levy releases

- Liens

- Offers In Compromise

- Installment Agreements

- 941 Payroll Taxes

- Penalty Abatement

- Innocent Spouse Relief

- Back taxes & unfiled tax returns

|